Why Choose Us

Benefits of Better Credit Score and Restoration

Approval for Higher Limits

Qualify for premium credit card offers with better rewards, perks, and features, enhancing your overall financial flexibility and benefits.

Qualify for Better Options

Increase your chances of loan approval for major purchases such as a home or car, giving you the ability to make significant investments.

More Negotiating Power

A higher credit score reflects responsible financial behavior, instilling confidence in lenders, creditors, and yourself regarding your ability to manage credit responsibly.

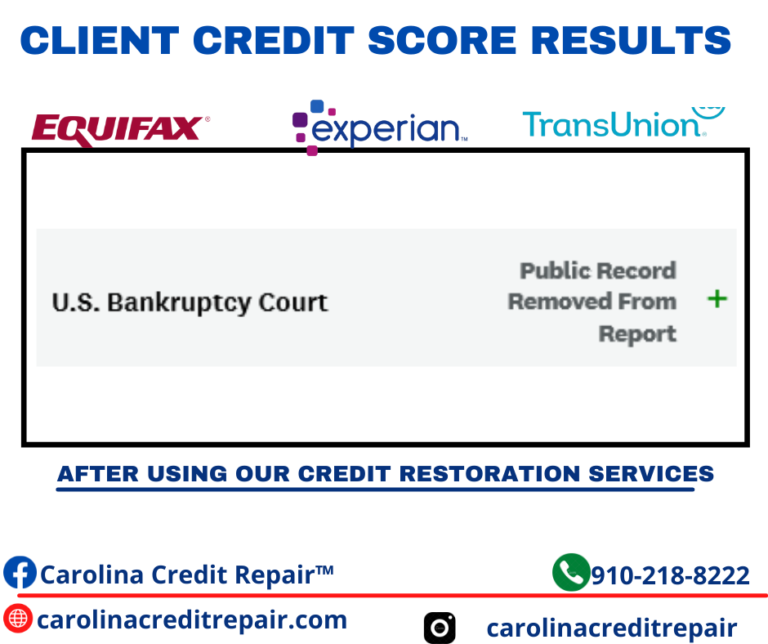

Credit Repair

Credit Repair

Credit Building

Credit Building

Education

Education

Business

Business